- Money Pro 2 0 – Manage Money Like A Problem Calculator

- Money Pro 2 0 – Manage Money Like A Problem Involving

- Money Pro 2 0 – Manage Money Like A Problem Solving

Money-management problems? Skynet 2020 14. You? If you are like so many other people, you find yourself from time to time in this situation. And you are certainly not alone.

Money Pro 2 0 – Manage Money Like A Problem Calculator

There are several reasons why so many of us have trouble handling our money responsibly. First, parents tend to pass down their poor money-management habits to their children because they lack the knowledge on how to deal with money issues themselves. If parents do not gain the knowledge necessary to handle their own money-management problems, it's likely that generations to come will continue to suffer financially as well.

If you're one of these parents or a young adult struggling with money-management problems, feel better knowing that part of the problem is also what you learned and didn't learn in school. Think back to your high school days when you were busy learning geometry, history, and science, do you recall taking a class called 'money management'? Affinity designer 1 8 17. Probably not.

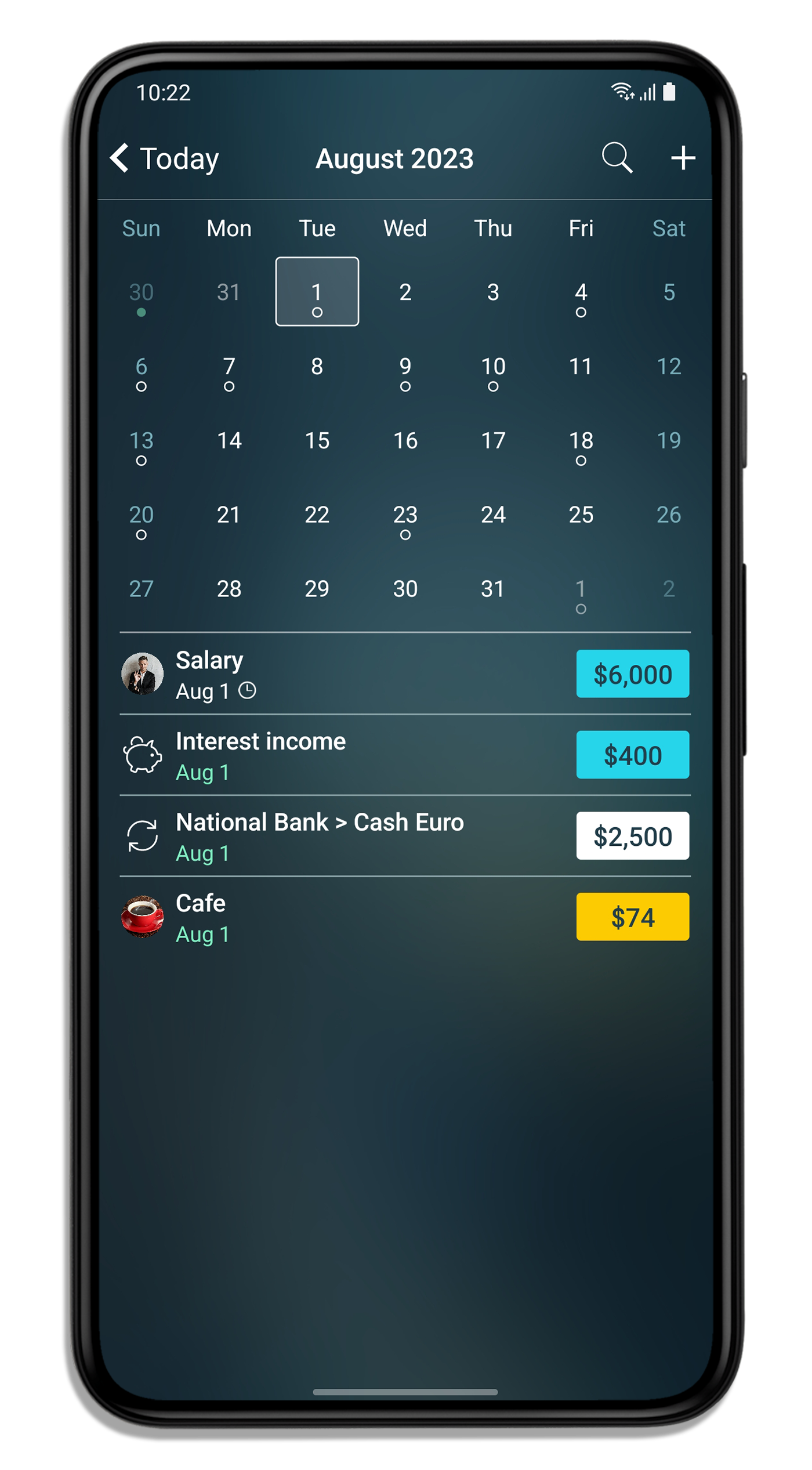

Money Pro Money Pro. General articles. Quick Start Guide; Frequently Asked Questions. Can I sync data between my devices? How do backups work? I bought Money Pro for one platform or subscribed to PLUS/GOLD. Do I have to pay for other platforms? Sometimes you might have to live off or Ramen noodles and hot dogs while other times you are eating steaks every day of the week. This will help you manage your money effectively by only spending the money you make. Keep track of your spending; When many of us depend on plastic money, it is easy to lose track of your spending.

Unless your job requires those types of subjects, how often do you find yourself needing the information you learned in those classes to make it from day to day? Probably very little to none! So it's not all your fault you were never actually taught how to effectively manage your money.

How do most people learn to manage money? They either teach themselves, or inadvertently learn from your parents (which we've covered), or they unfortunately never really learn the skills it requires. The result? Persistant money-management problems.

It would be nice if high schools offered some sort of money-management course as a requirement! This type of course wouldn't only need to teach kids how to be frugal, but also actual money management principles. At Everyday Wisdom LLC, We feel a course of this type would prove to be the lesson of a lifetime, and we think you would agree!

Money Pro 2 0 – Manage Money Like A Problem Involving

Now, let's get back to real life! Primocache keygen. If you have children, it is important to understand that they too are not likely to be taught financial responsibility in high school because most schools just don't offer it. So, in essence, it is the parents' responsibility to teach their children financial responsibility at home.

There is just one catch.you, yourself, must overcome your money-management problems by developing a solid grasp on effective lifelong, money management techniques and practicing them everyday before you can effectively teach your child. Kakaotalk for ipad free download.

Do you regret any financial decisions you've made in the past? You're not alone! We all have some regrets on how we've handled our money in the past. If you don't , then you are certainly a rarity because not too many people can say they always make good money-management decisions.

Here are some suggestions on how to minimize the number of money-management problems you find yourself in: Scrapple 1 3 4 x 4.

- Learn from your own as well as others' mistakes.

- Don't repeat a mistake - your own or someone else's that you know.

- Learn not only from your mistakes but from the smarter decisions you've made along the way as well as from others who have had good success with their money.

- When you find that you've made a good money-handling decision, cherish it and share it with your children, family members, and friends.

Do you regret any financial decisions you've made in the past? You're not alone! We all have some regrets on how we've handled our money in the past. If you don't , then you are certainly a rarity because not too many people can say they always make good money-management decisions.

Here are some suggestions on how to minimize the number of money-management problems you find yourself in: Scrapple 1 3 4 x 4.

- Learn from your own as well as others' mistakes.

- Don't repeat a mistake - your own or someone else's that you know.

- Learn not only from your mistakes but from the smarter decisions you've made along the way as well as from others who have had good success with their money.

- When you find that you've made a good money-handling decision, cherish it and share it with your children, family members, and friends.

Here are some common sense, easy-to-use suggestions to help you get back on track solving your money-management problems:

- Open up a 'free checking account'.

- Always keep your checkbook balanced! Remember to include all debit transactions so as not to incur NSF fees later on.

- Pay all bills on time! This will help you establish and keep a good credit rating, as well as help you avoid 'late fees'.

- Pay your credit card balances in full each month to avoid finance charges.

- Look for credit cards that offer 'no annual fee', and one that offers the lowest APR.

- Don't spend more than you earn.

- Don't put items 'on sale' on your credit card if at all possible. By the time you add-in any finance charges, it makes any 'savings' fruitless.

- Vehicles are a depreciating asset. Never buy a brand new car.buy cars that have already had some depreciation, i.e., lease returns, etc. Plan on driving a vehicle for three years after it is paid off and continue putting the same amount of the prior monthly payments into a savings account. When you're ready to purchase your next vehicle, you will have a large sum to put down, thus, financing less next time!

- Take advantage of company-provided 401K's, stock options, and maximize your savings.

- Always keep a cash reserve for any emergency. If your heating and air conditioning unit goes out, it's better to take the money from the emergency fund rather than financing the cost for replacement.

Just because some of us have made mistakes in the past, doesn't mean we have to continue making them in the future.

House Tips | Auto Tips | Sports/Hobbies | Grandma's Tips |

Wisdom & Humor |

Money Pro 2 0 – Manage Money Like A Problem Solving

SBI!